Mitsui Fudosan, Tishman Speyer Investing in California Shed Projects Via $500M JV

2225 Jerrold Ave is about to get a makeover

Mitsui Fudosan has made its first foray into American warehouses with the Japanese real estate giant announcing investments in a pair of California logistics projects through an existing partnership with US developer Tishman Speyer.

Japan’s largest developer said on Monday that it will work with Tishman Speyer to upgrade a San Francisco facility, with the partners also agreeing to will start construction on a 55,300 square metre (596,000 square feet) warehouse in Orange County next year, according to a press release from Mitsui Fudosan. The partners jointly acquired both projects in the past eight months.

“The US logistics real estate market has been trending favourably, supported by a strong domestic consumer mindset, expansion of the e-commerce market, and dynamic growth in logistics demand driven by the emergence of omni channels,” Mitsui Fudosan said in its press release.

The two projects are part of a $500 million strategy announced by Mitsui Fudosan and Tishman Speyer in November 2022 to acquire, develop, and renovate industrial properties in major urban centres across the US.

Californian Projects

In Orange County, Tishman Speyer and Mitsui Fudosan are developing what is tentatively named Great Park Parcel 1 in the southern California city of Irvine. Scheduled to be completed by 2027, the complex will comprise four single-storey buildings.

The upcoming project is poised to benefit from its location along the I-5 and I-405 highways which connect it to the port of Long Beach, the second busiest trade gateway by container volume in the US last year. The asset is also situated around 15 minutes’ drive from John Wayne Airport.

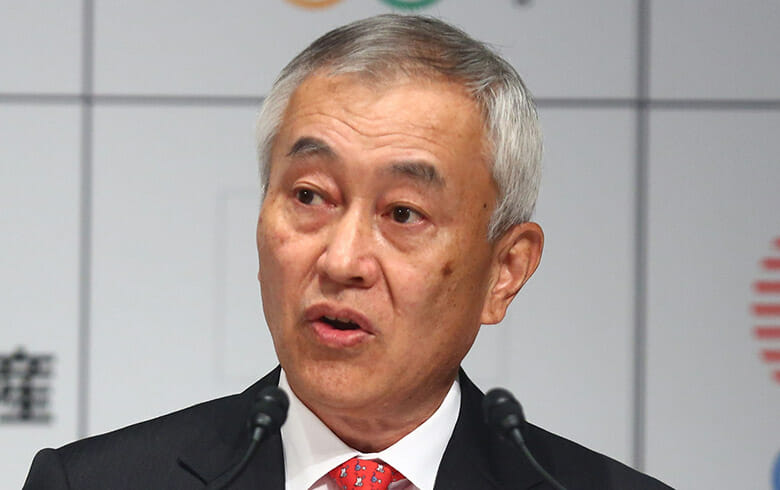

Mitsui Fudosan chairman Masanobu Komoda (Getty Images)

The joint venture acquired the 129,095 square metre site for the project from Irvine-based developer FivePoint in January for $146 million, Tishman Speyer revealed in a LinkedIn post at the time of the deal’s closing.

Average monthly asking rates for warehouse space in Orange County grew 14.6 percent at the end of 2023 from a year earlier, reaching $1.76 per square foot, according to a report from Savills. That figure came as developers deployed 4.4 million square feet of industrial inventory in 2023, which was up 144 percent from the 1.8 million square feet rolled out a year earlier.

The joint venture will also invest in upgrading 2225 Jerrold Ave in San Francisco, an 8,200 square metre warehouse which Tishman Speyer purchased for $32.8 million from local private art school Academy of Art University in July of last year. The partners have not yet provided details of their plans for the single-storey facility.

With tenants in San Francisco’s industrial market giving up 5,275 square metres more than they took up in the final quarter of last year, vacancy rose to 6.6 percent at the end of 2023, up by 2.6 percentage points from a year prior, according to a report from CBRE.

The pair of projects come as e-commerce sales in the US grew 7.6 percent in 2023 from year-earlier levels to $1.1 trillion, according to the most recent report from the US Census Bureau. That figure accounted for 15.4 percent of all transactions in the country last year, up 0.7 percentage points from 2022.

US Shopping Spree

Mitsui Fudosan’s California investments come as Japanese’s largest developers continue to expand their US portfolios, with the joint venture commitment being announced around six weeks after Sekisui House agreed to buy out Denver-based builder MDC Holdings for $4.95 billion. Once complete, that deal will make Sekisui the fifth largest homebuilder in the world’s biggest economy.

Japan’s largest homebuilder, Daiwa House Group announced in January that it has signed a deal to acquire single-family residential developer The Jones Company of Tennessee, with that acquisition taking place after the Osaka-based firm had acquired California-based detached housing specialist JP holdings in October.

In November, Sumitomo Forestry said it was teaming up with California-based Fairfield Residential in a JPY 21.3 billion ($144 million) joint venture to develop a 400-unit rental residential building in the suburbs of Washington, DC.

Japanese investors more than doubled their capital commitments to income earning real estate assets across the Americas last year, according to data from MSCI Real Assets. Investors from Asia’s second-largest economy acquired $2.95 billion worth of investment properties across North, Central and South America in 2023, according to the market data provider, which was up 120 percent from a year earlier.